Windermere Real Estate

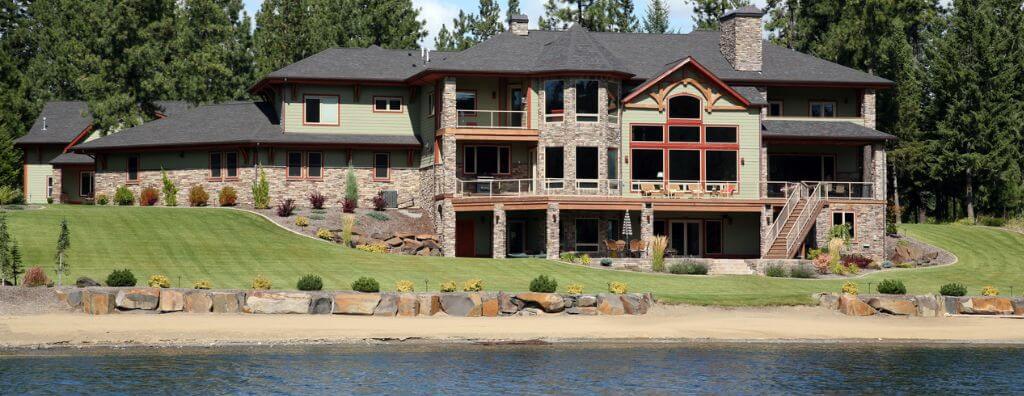

What does it mean for a real estate company to be all in? It means we love what we do, and it comes across in all that we do. It means we sweat the details, so our clients don’t have to. It’s a belief in acting beyond ourselves and caring deeply about the communities we serve. It’s what sets us apart from all the rest.

Relationships,

not transactions

Joyful, compassionate,

and full of deep knowledge,

we help our clients turn their

dreams into reality.

Our insight,

your advantage

We offer a proprietary mix of

advocacy, ingenuity, and

insight that helps people

move confidently into their

next chapter.

Building local

communities

Together, we strengthen the

fabric of local communities

through our actions and

contributions.

What's your next move?

Featured Real Estate Posts

The power of windermere

0K

Home Sales0+

Associates0+

offices0

states$0M

RaisedThe Human Algorithm™

There's a secret formula that makes Windermere different, and it all starts with our people. This video gives you insight into our unique culture and approach, and what our difference means for you.

Your guide to buying

Your guide to buying

Your guide to selling

Your guide to selling